Introducing thGOLD: Gold That Works for You

Jan 27, 2026

·

3

MINUTES

For centuries, holding gold meant paying anywhere from 0.5% to 1% in fees for warehousing, security, and transport costs. In 2003, that changed: Gold Bullion Securities launched the first Gold ETF to make gold exposure liquid and accessible. Physical custody headaches disappeared, but investors were still paying 0.1-0.5% in fees while subject to the terms and trading hours of their jurisdiction. ETFs improved conditions for those interested in access, but both methods leave money on the table.

It's time for gold that works for you. Today, we're launching thGOLD.

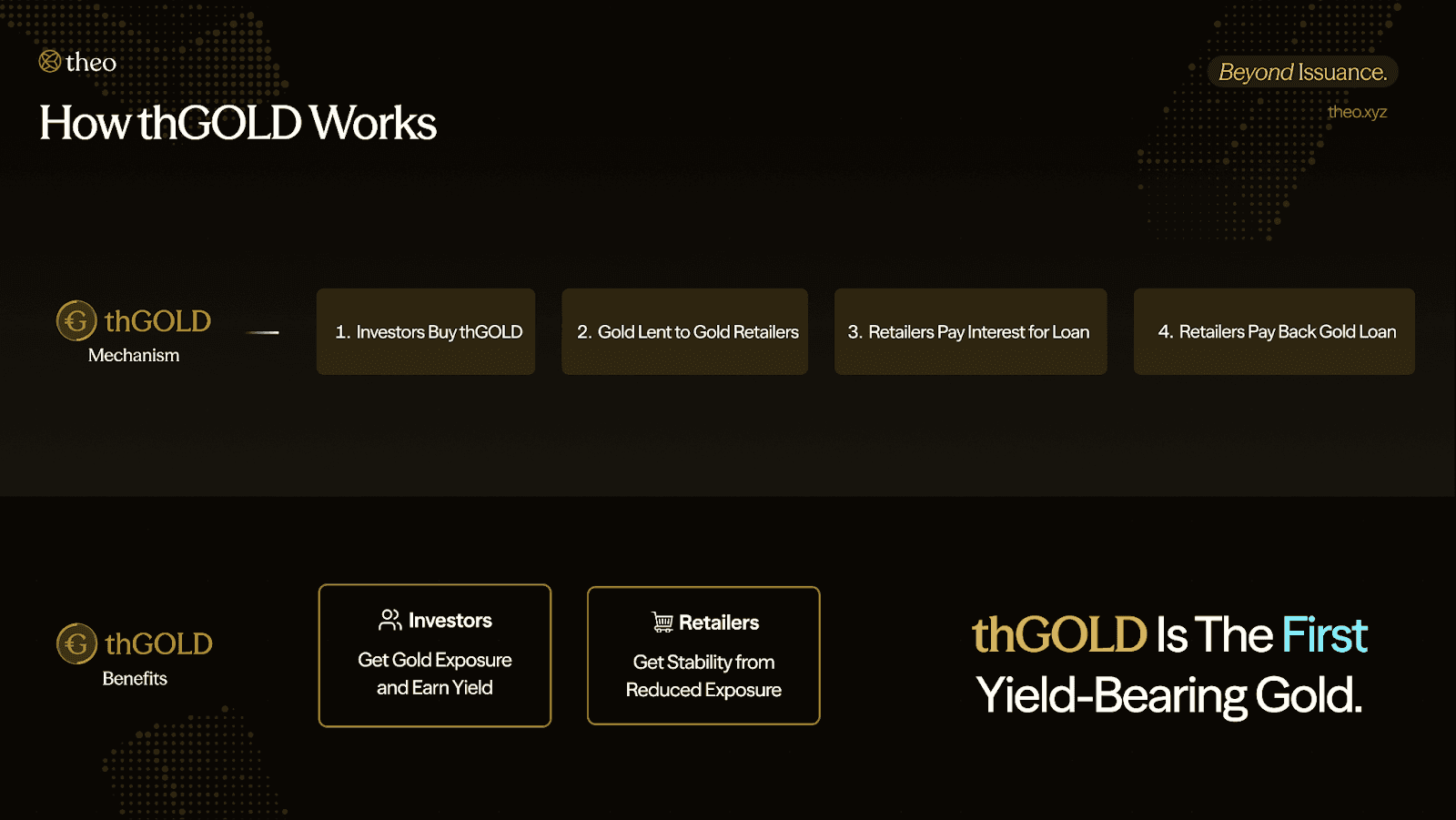

thGOLD introduces a new approach to gold. Instead of charging investors to warehouse gold, it generates yield through gold-denominated loans to established retailers. They use it for inventory, then return the same amount plus interest. This transforms gold from a cost center into a yield-bearing asset.

About thGOLD

thGOLD is a tokenized yield-bearing gold product that tracks the MG999 Onchain Gold Fund, a secured private credit fund operated by FundBridge Capital and supported by Libeara's tokenization infrastructure. Mustafa Gold, one of Singapore's largest and longest-standing gold retailers, is the fund's initial borrower.

Unlike traditional gold holdings that charge storage fees, thGOLD generates approximately 2% annual yield, creating a foundation for more sophisticated strategies like delta-neutral positions and leveraged structures that aren't possible with non-yielding gold products.

Like thBILL, thGOLD launches with the full infrastructure stack needed to compete with traditional markets:

Professional market making integrated across spot and perpetual markets

Onchain composability via full integration with lending protocols and derivative markets

Institutional custody through proven partnerships

What This Enables

For Individual Investors: Access to yield-bearing gold exposure with full onchain composability. Earn approximately 2% annually while using thGOLD as collateral for leverage or capital efficiency without paying vaulting costs.

For Institutions: Seamless onchain gold exposure without the operational complexity of physical custody or managing multiple platforms.

For the Ecosystem: A commodities foundation that transforms a traditionally non-productive asset into an income-generating instrument with capital and operational efficiency.

Why Gold, Why Now

Gold delivered 60%+ returns in 2025, and is already up over 15% in 2026. Demand for gold exposure is at an all-time high among both retail and institutional cohorts, and existing tokenized gold products lack the trading infrastructure to capture that demand effectively.

thGOLD solves this by leveraging Theo's reusable tokenization infrastructure: the same institutional partnerships, market-making relationships, and multi-venue distribution channels that powered thBILL’s successful launch to over $200M in TVL and ~$1B in cumulative trading volume within approximately five months.

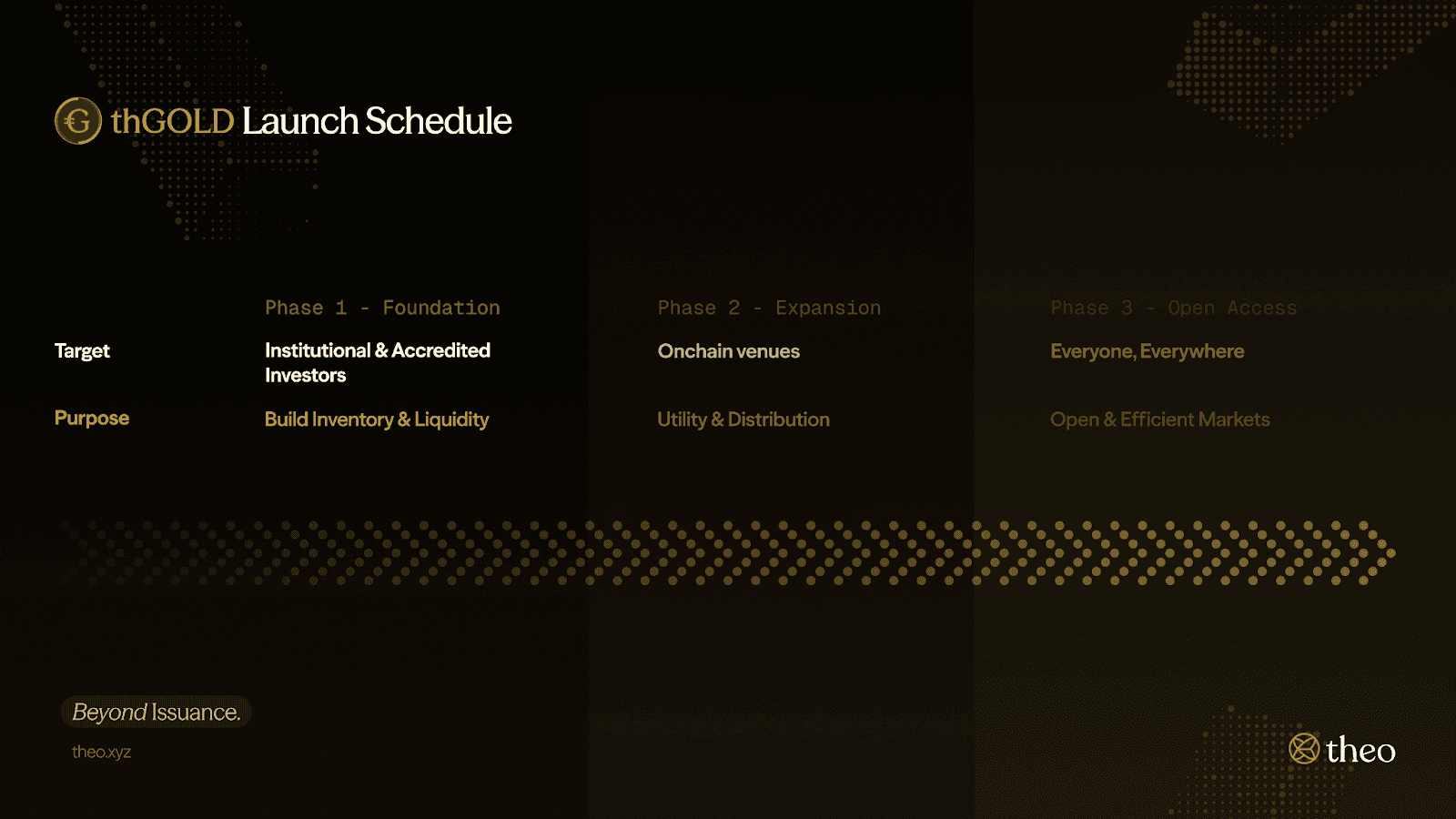

thGOLD Launch Schedule

A tokenized asset without liquidity or integrations is just a wrapper. That's why we're launching thGOLD in phases – the same approach we used to scale thBILL to $200M TVL.

About MG999

MG999 is a secured private credit fund operated by FundBridge Capital and supported by Libeara's tokenization infrastructure. The fund provides gold-denominated loans to established retailers like Mustafa Gold, one of Singapore's largest.

They use it for inventory, then return the same amount plus interest. Rather than buying bullion and paying for storage, the fund generates yield through these gold-denominated loans.

While this introduces credit risk on gold retailer counterparties, investors are protected by security over gold inventory and a 20% first-loss buffer held by the fund sponsor.

What’s Next

thGOLD represents the next chapter in Theo's full-stack tokenization platform, demonstrating our ability to tokenize complex, yield-bearing strategies with institutional partners, proving our model works beyond short-duration Treasuries.

Get Started

Phase 1 is open now for institutional partners and accredited investors.

Apply for early access: theo.xyz/thgold

About Theo

Theo is a full-stack tokenization platform connecting onchain capital to global markets. Built by former traders from Optiver, IMC Trading, and institutional investment professionals from UBS and Polygon Ventures, Theo provides end-to-end infrastructure for institutional-grade tokenized assets including treasuries, commodities, and equities. The platform has raised $20M in Series A funding led by Mirana Ventures, Hack VC and Anthos Capital.

Disclaimer: Yield figures are approximate and based on current market conditions. Actual returns may vary and are not guaranteed. thGOLD involves exposure to credit risk on gold retailer counterparties. Investors should review the full risk disclosures before investing.